The fundamental difference between the Help to Buy Mortgage Guarantee scheme and the Equity Scheme is that The Equity Scheme is only for new build properties whereas the Guarantee Scheme is for older properties.

A mortgage supported by the Help to Buy Mortgage Guarantee Scheme works in exactly the same way as any other mortgage except that under the scheme the Government offers lenders the option to purchase a guarantee on mortgage loans.

Because of this support, lenders taking part are able to offer home buyers more high-loan-to-value mortgages up to 95%.

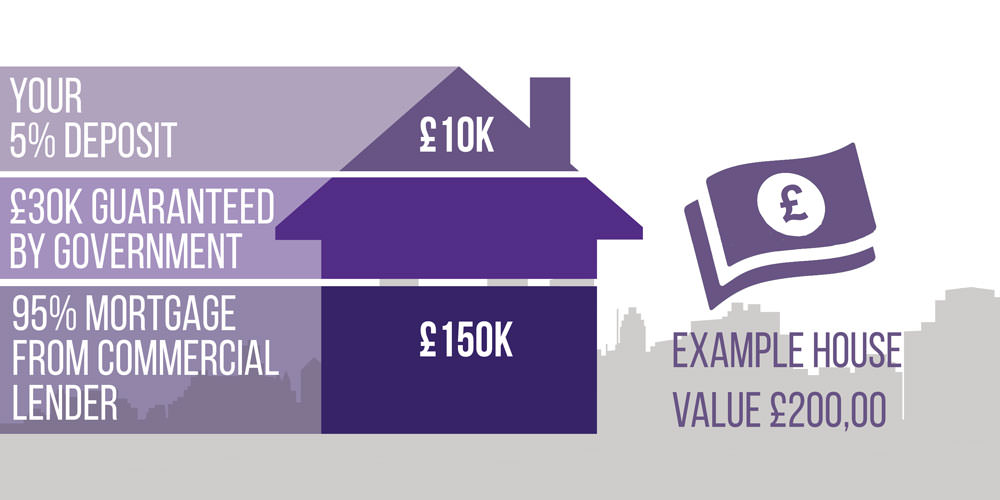

Example: for a home with a £200,000 price tag

A mortgage under the Help to Buy Mortgage Guarantee Scheme works like any other mortgage. Your lender will check that you can afford the mortgage and that you do not have a history of payment difficulties.

To qualify for a mortgage supported by Help to Buy Mortgage Guarantee:

The Help to Buy Mortgage Guarantee Scheme is run by Government-appointed Help to Buy Agents. The Help to Buy Agent for Wiltshire is Help to Buy South. At Impartial Financial Management we are able to guide you through your purchase, from providing general information about the scheme to helping find the right mortgage for you.